Wealth Advisory

Investment Philosophy

Powell Investment Advisors’ investment philosophy is the cornerstone of our wealth advisory platform. We strive to understand your unique needs in order to provide you with a personalized investment portfolio. Our mission is to assist you in managing time horizons and market volatility by implementing a diversified asset management strategy designed to maximize wealth and minimize investment risk relative to your financial goals. We utilize an open architecture platform that enables us to provide unbiased advice and align our interests entirely with yours.

Asset Allocation

A thoughtfully designed diversified asset allocation is the foundation to achieving long-term investment goals. The asset allocation must (i) meet your specific financial needs; (ii) be designed to withstand market volatility; (iii) provide diversification across multiple asset classes to minimize risk; and (iv) have a low fee profile.

In it for the Long Haul

It is important to be knowledgeable about current market conditions, but paying too much attention to market movements can interfere with achieving your long-term objectives. Neuberger Berman’s founder Roy Neuberger, at age 105 said, “Market bottoms are made coincident with bad news, while market tops are made in the face of good news.” Most of the time, a market’s daily or even weekly ups and downs are empty “noise” that provide little guidance about its long-term direction. Regardless of the economic landscape, fundamental economic data can always support both a bullish and bearish outlook.

Over the long-term, markets have trended steadily upward. Yet, what you experience day to day can be unnerving. It is natural to react to today’s news, but doing so can deprive you of meeting your long-term financial goals. The impulse to time markets usually results in mistiming them, sometimes disastrously. Since the low in March 2009, the market has consistently surprised those who kept waiting for another shoe to drop. Underestimating the market’s ability to come back, especially when it looks to be on the brink of a major breakdown, has historically been a losing strategy.

Market timing has long been the curse of investors seeking to grow their wealth over time. Investors are human, and they tend to succumb to flawed, emotion-driven decision making. In fact, most people’s desire to avoid losing money is greater than their desire to earn it. Fear and greed are powerful forces and are the main reasons downturns and bubbles are amplified.

Market Timing

Why is it so hard to time markets? Because there is no single variable, or combination of variables, that is a foolproof forecasting tool. Remember, the stock market is a discounting mechanism. It reflects future events ahead of time. Like many investors, we pay close attention to economic data. Economic trends, however, haven’t demonstrated a high degree of success as predictors of stock performance. Consider the following market dynamics: recession, rising interest rates, climbing gold prices, and high oil prices – all are perceived signals of stock market downturns. As depicted in the chart to the right, and contrary to popular belief, it is more likely than not the markets will rise in the 12 months after these negative indicators have dominated the economic headlines.

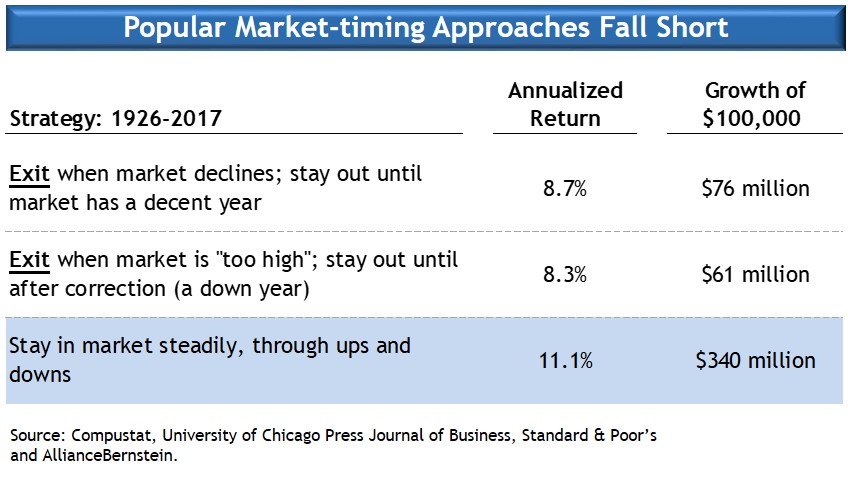

To take this one step further, let’s consider two of the most popular market timing strategies:

- Exit the market following a losing year and reenter when a recovery appears

- Exit when things have been looking good for too long and return after a correction

Investors pursuing the first strategy (loss avoidance) would have seen their portfolios compound at an average of 8.7% a year. The second strategy would have seen an annualized return of 8.3% a year. Both groups, however, would have trailed investors who stayed in the market through good times and bad. They earned 11.1%, on average. Although the percentage change doesn’t seem significant, the compounding effect can result in over 4x as much wealth generation in an investor’s lifetime.

Bear Markets’ Bite: Painful but Short

It is difficult to not be concerned when your investments decline sharply. But building up tolerance for short-term losses is crucial. By remaining fully invested for the long-term, investors have been able to reap the rewards of bull markets, which are far greater than any setbacks dealt by bear markets. History shows that bear markets tend to be short-lived compared with bull markets.

Since WWII, there have been 12 S&P 500 declines of 10% or more. The majority lasted less than a year, on average, and regained their prior highs within eight months. Of course, the recoveries were realized only by the investors who didn’t sell.

The worst of the downturns was the recent “Great Recession,” between September 2007 and March 2009, which saw the S&P 500 fall by 57%. Many disheartened investors liquidated their equity portfolios, often at a loss, due to fear of additional losses and missed out on the ensuing recovery. Although it took more than five years to recover, the important point is that the losses were recouped by investors that stayed invested. Investors who liquidated their portfolios locked in permanent losses and missed out on the chance to participate in the 26% return in 2009 alone.

The Penalty for Guessing Wrong

Market timing would be difficult enough if it involved only one correct guess on where stock prices were headed. In reality, it involves two: when to get out of the market and when to get back in. You have to guess right in both directions, and as illustrated in the chart above, being out of the market can be costly.

Throughout the entire period from 1974-2016, the average annual return of the S&P was 13.6%. Missing out on just the best 10 days (out of more than 9,828) reduced the return to 11.6%. Missing out on the best 50 days reduced the return to 7.7%, approaching that of Treasuries.

Although past performance does not guarantee future results, we believe the best approach to building wealth is by not trying to catch the upswings and dodge the downswings, but by remaining invested in a well-diversified portfolio of stocks and bonds. It has been our experience that investing in a diverse array of asset classes—and sticking with that plan over the long term—is the most effective way to take advantage of the markets’ long-term upward trends and build wealth.